A small survey by @zebulgar went viral on Twitter in the past few months. It showed that nearly 52 percent of students would rather be a type of influencer or online personality instead of pursuing a traditional career. Truth be told, plenty of Twitter users were questioning the validity of the survey, as the original poster (@zebulgar) did not provide any sort of accompanying statistics. However, it brought up a great question–what makes these social media careers so appealing?

While some Twitter users have claimed it’s because children don’t want to work (which is a rather funny point, because there were numerous kids that came before Gen Z wanting to be princesses and celebrities), the truth lies in the fact that influencers are a breed of celebrity whose job is merely to be present online. Almost everyone in the world already is. When kids imagine future jobs, they usually cannot imagine the mountains of paperwork that come with being a lawyer. The real question is, how can kids be expected to envision a future for themselves when their futures begin to look like mountains of debt?

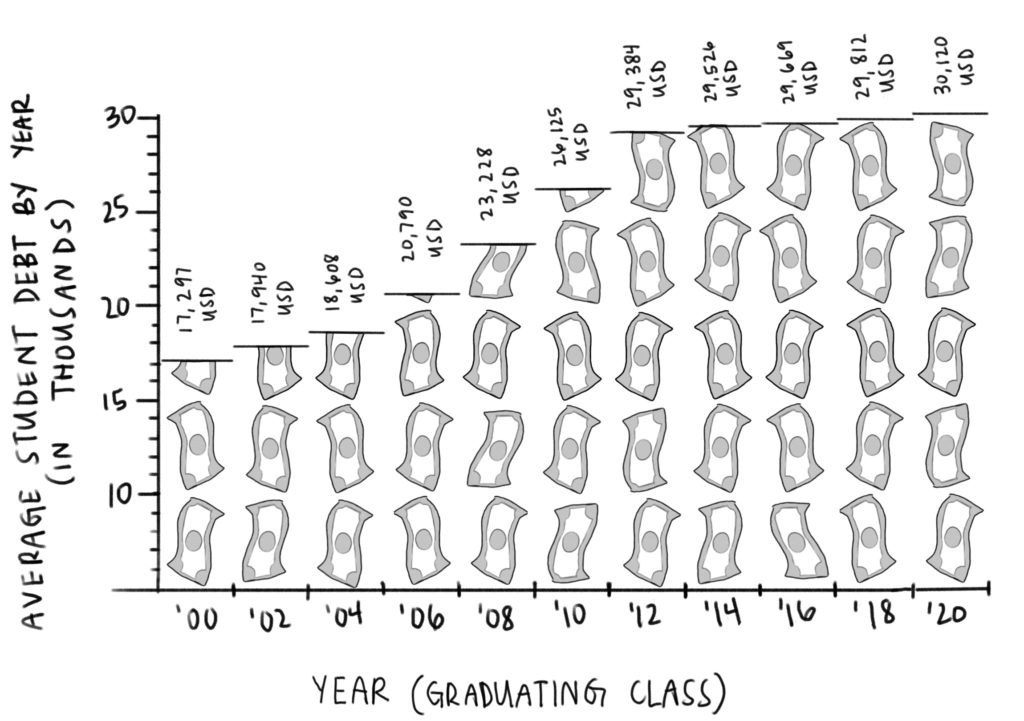

Since 1993, the average student loan debt for an individual student has been multiplied by ten. Students now not only pay more in tuition, but the ability to pay off loans has decreased. In 1967, the average cost for a public four year school per year was about $2,607 (adjusted for inflation).

In 2020, the average cost of a four year education at an in-state public school is closer to $10,000. Keep in mind that these figures represent tuition alone, without the other charges and fees most schools will charge students for various resources.

“Currently, there is $1.6 trillion in outstanding student loan debt,” writes Robert Farrington, founder of the personal finance site, thecollegeinvestor.com. “The bulk of this debt is Federal student loan debt, followed by private loans.”

Farrington advises his readers to consider the return on investment of student loans.

“To make your student loan debt ‘worth it,’ you need to maximize your earnings potential,” wrote Farrington. “A good rule of thumb is to never borrow more than you expect to earn in your first year after graduation. For most average student loan debt borrowers this year (where the average is $29,900), that’s possible in most career choices.”

Philip Olson and Julia Lorenz-Olson, from the personal finance YouTube channel Two Cents, discuss how to make important career decisions with money in mind in their video titled, “What College Majors Are Worth the Money?”

“Colleges have no incentive to control costs because they know the federal government and other loan agencies will keep fronting the money,” said Lorenz-Olson.

“Administration costs have ballooned as much as 60 percent in the last 25 years,” said Olson. “A lot of that gets blamed on perks that colleges are adding to attract customers–I mean, students.”

“There is no denying college is a financial investment,” said Lorenz-Olson.

While true, it doesn’t negate the fact that an investment is money one already has, that is paid forward in hopes of that money increasing in the future. Students take out loans–money they don’t have–in the hopes that they will have money in the future to pay it back. It is piling negatives onto a zeroed out bank account. This fact dictates which careers students choose. While there is no lack of art or film majors, it does seriously affect the amount of students choosing financially stable careers over a future they are seriously passionate about.

This doesn’t necessarily mean that the government should pass legislation to make all colleges free, or that colleges need to lower tuition. There are so many economical factors that play into the issue that nailing one cause is nearly impossible. The best students currently in college can do is simply to learn all they can about personal finance and only take out loans from trustworthy institutions.